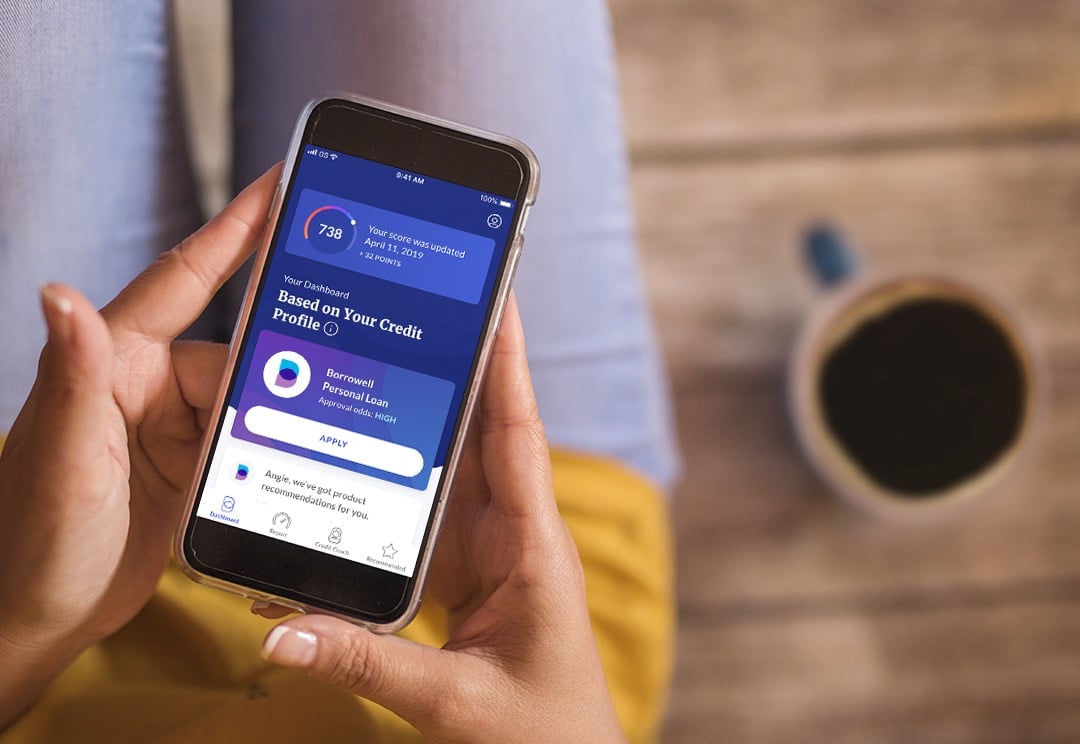

Borrowell is a leading Canadian fintech company dedicated to helping individuals understand and improve their financial health. With over 3 million happy members, Borrowell offers free credit scores, personalized financial recommendations, and a variety of financial products designed to meet diverse needs. This comprehensive guide explores the numerous services and benefits offered by Borrowell, motivating readers to join and take control of their financial future.

Start with Your Free Credit Report

Access Your Free Credit Score

Joining Borrowell gives you free access to your Equifax credit score and report. It’s an essential tool for anyone looking to understand their financial standing and improve their credit.

- Sign Up for Free: It takes just three minutes to sign up and start accessing your credit score and report.

- Weekly Updates: Receive weekly updates on your credit score and get notified of any changes.

- No Impact on Credit Score: Checking your score with Borrowell does not hurt your credit.

Why Canadians Love Borrowell

Borrowell is not just about providing free credit scores. It offers a comprehensive suite of tools and resources to help you achieve your financial goals.

- Free Credit Score Tracking: Track your credit score weekly without any cost.

- Bank-Level Security: Enjoy peace of mind with 256-bit encryption, ensuring your data is secure.

- Personalized Recommendations: Get tailored financial product recommendations based on your unique credit profile.

- Credit Improvement Tips: Benefit from educational tips and advice to help you improve your credit score.

- No Hard Hits: Checking your score with Borrowell won’t negatively impact your credit score.

How Borrowell Works

Quick and Easy Sign-Up

Signing up with Borrowell is fast and straightforward, allowing you to access your credit score and report in just a few minutes.

- Three-Minute Sign-Up: Complete the registration process quickly and easily.

- Free Weekly Credit Monitoring: Keep an eye on your credit with free weekly updates and alerts.

Credit Education

Borrowell provides valuable credit education, helping you understand your credit score and offering personalized tips to improve it.

- AI-Powered Credit Coach: Gain insights and personalized advice from Borrowell’s AI-powered Credit Coach.

Product Recommendations

Borrowell partners with over 75 financial institutions to provide personalized recommendations for financial products that match your credit profile.

- Compare Financial Products: Explore a wide range of products, including credit cards, loans, and mortgages.

Financial Products Offered by Borrowell

Borrowell offers a variety of financial products designed to help you achieve your financial goals.

Personal Loans

Borrowell makes it easy to find and compare personal loans that suit your financial profile.

- Get a Loan Now: Access loans with competitive rates and terms tailored to your needs.

Credit Cards

Discover the best credit card options based on your credit score and financial needs.

- Find My Card: Explore personalized recommendations for credit cards that offer the best benefits and rates.

Mortgages

Compare mortgage rates and providers to find the best deal for your home financing needs.

- Compare Rates: Get the most competitive mortgage rates available in Canada.

More Financial Products

Borrowell also offers recommendations for various other financial products, including banking, insurance, and investing.

- Banking: Find the right bank accounts to manage your money effectively.

- Insurance: Compare auto and home insurance options to find the best coverage.

- Investing: Get advice on the best investment products based on your financial goals.

Trusted Partners

Borrowell partners with some of the top financial institutions to provide the best product recommendations for its users.

- Partners Include: Amex, Capital One, BMO, Scotiabank, EQ Bank, National Bank, and more.

Additional Resources

Borrowell offers a wealth of resources to help you understand and manage your credit better.

Credit Score and Report

Learn how to check your credit score in Canada and understand what the numbers mean.

- Get Your Credit Score: Access your free Equifax credit score and report anytime.

- Weekly Updates: Stay informed with weekly updates on your score.

Educational Articles

Borrowell provides informative articles on various financial topics to help you stay informed and make better financial decisions.

- Credit Score Impact: Understand how late payments affect your credit score.

- Improvement Tips: Discover practical steps to improve your credit score.

- Credit Reports: Learn the difference between credit scores and credit reports, and how to read your credit report effectively.

Join Borrowell Today

Joining Borrowell is a step towards better financial health and security. With a range of tools and resources at your disposal, managing and improving your credit has never been easier.

- Sign Up for Free: Start your journey to financial wellness by signing up for Borrowell today.

- Secure and Reliable: Enjoy bank-level security and peace of mind with Borrowell’s 256-bit encryption.

Conclusion: Empower Your Financial Future with Borrowell

Borrowell offers a comprehensive and user-friendly platform for understanding and improving your financial health. With free credit scores, personalized product recommendations, and a variety of financial products, Borrowell is your partner in achieving financial success. Join the 3 million Canadians who trust Borrowell and take control of your financial future today. Happy managing!

.jpg)