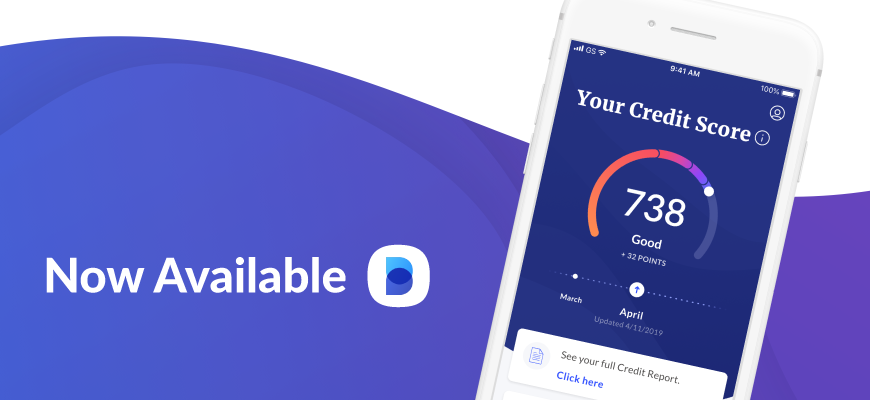

Borrowell is a leading financial technology company in Canada, dedicated to helping Canadians achieve their financial goals. By providing free credit scores, credit reports, and personalized financial product recommendations, Borrowell empowers millions of users to take control of their financial health. Discover the benefits of joining Borrowell’s community and start your journey towards better financial well-being today.

Join Millions of Happy Members

Borrowell has already helped over 3 million Canadians access their free credit scores and reports. As the first company to offer free credit monitoring in Canada, Borrowell is proud to provide an essential service that empowers individuals to understand and improve their financial standing. Sign up for free and join a growing community of satisfied members.

Why Canadians Love Borrowell

Borrowell is more than just a credit score provider. Here are the top reasons why Borrowell stands out:

Free Credit Score Tracking

Enjoy free weekly credit score and report monitoring. Keep track of your financial health without any cost.

Bank-Level Security

Rest assured that your information is safe with Borrowell’s bank-level security, featuring 256-bit encryption.

Personalized Recommendations

Receive personalized financial product recommendations based on your unique credit profile.

Credit Improvement Tips

Benefit from free credit improvement tips and educational resources provided by Borrowell’s AI-powered Credit Coach.

No Hard Hit

Checking your credit score with Borrowell won’t hurt your credit score, allowing you to monitor your financial health worry-free.

How Borrowell Works

Quick and Easy Sign-Up

Sign up with Borrowell in just under three minutes to gain free access to your Equifax credit score and report, updated weekly.

Credit Improvement Education

Borrowell’s AI-powered Credit Coach helps you understand your credit score and offers personalized tips to improve it.

Product Recommendations

Compare financial products from over 75+ partners and receive tailored recommendations that match your credit profile.

Your Credit Score and Report – All in One Place

Access your Equifax credit score and credit report for free with Borrowell. Check your credit score or download your credit report anytime. Receive weekly updates, personalized tips, and find the best financial products tailored to your profile. Best of all, checking your score with Borrowell does not impact it.

Is All This Really Free?

Yes, it’s truly free. Borrowell generates revenue by analyzing your credit profile and suggesting the best financial products for you from over 50 different companies. If you choose one of their recommendations, the partner company pays a referral fee. Even if you’re not interested in the recommendations, Borrowell is happy to provide your free credit score.

Explore Borrowell’s Products

Personal Loans

Borrowell helps thousands of Canadians easily access personal loans that suit their financial profile.

Credit Cards

Find the best credit card for your needs with personalized recommendations from Borrowell.

Mortgages

Compare mortgage providers and find the best rates in Canada with Borrowell.

Banking and Insurance

Discover the right bank account and insurance options that align with your financial goals.

Trusted Partners

Borrowell partners with top financial institutions to offer the best product recommendations, helping customers achieve their financial goals.

More Credit Score Resources

Borrowell provides valuable insights and educational resources to help you better understand your credit score and how to improve it. Here are some popular articles:

COVID-19 Impact on Credit Scores and Missed Bill Payments

Understand how the COVID-19 pandemic has affected credit scores and payment trends across Canada.

How Late Payments Impact Your Credit Score

Learn about the significant impact of late bill payments on your credit score.

Tips to Improve Your Credit Score

Explore eight tangible steps to improve your credit score in Canada.

Credit Scores vs. Credit Reports: What is the Difference?

Understand the difference between credit scores and credit reports and their importance.

How to Read Your Credit Report

Get a clear breakdown of how to read your credit report, including what information it contains and how it affects you.

How Long Does Information Stay on My Credit Report?

Find out how long various types of information remain on your credit report.

What Credit Score is Needed for a Car Loan?

Learn about the credit score requirements for obtaining a car loan in Canada.

What Credit Score is Needed for a Mortgage?

Discover the credit score needed to qualify for the best mortgage rates in Canada.

Hard vs. Soft Credit Inquiries

Understand the difference between hard and soft credit inquiries and their impact on your credit score.

Conclusion

Borrowell is the ultimate financial partner for Canadians seeking to improve their financial health. With free credit scores, personalized recommendations, and educational resources, Borrowell makes it easy to take control of your finances. Join the millions of happy members and start your journey to financial well-being today with Borrowell!